Learning to trade in the financial markets can be challenging, especially for beginners. For those new to the world of investing, what is paper trading is often one of the first concepts they encounter. Paper trading is a method that allows individuals to practice trading without risking real money. This article will explore effective paper trading strategies to help beginners get started.

Understand the Basics of Paper Trading

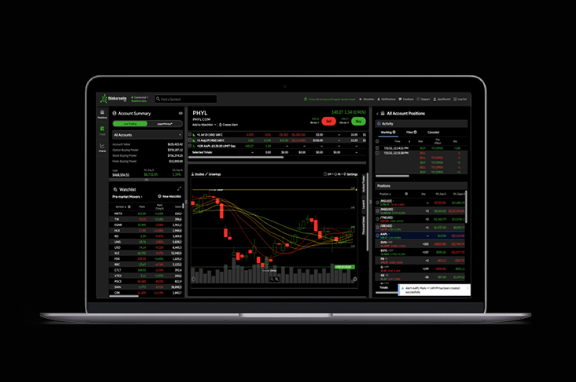

Before diving into strategies, it’s important to understand what paper trading involves. Paper trading is a simulation where beginners use a virtual trading platform to buy and sell stocks, currencies, or other financial instruments without using actual money. This allows them to gain experience in the market, test strategies, and build confidence without the fear of losing real funds. By using this approach, new traders can learn the market mechanics, understand the impact of market movements, and observe their decisions in a risk-free environment.

Start Small and Focus on One Market

One common mistake for beginners is trying to trade across multiple markets simultaneously. When paper trading, it’s best to start small and focus on one market, such as stocks or forex. Narrowing the focus helps beginners become familiar with the dynamics of that specific market. By understanding how a single market works, traders can easily track its trends and fluctuations. This strategy allows them to develop a solid foundation before expanding into other markets, making them more prepared when they eventually transition to live trading.

Use a Clear and Consistent Trading Plan

A key to success in both paper and live trading is having a solid trading plan. Paper trading provides an excellent opportunity to create and refine a trading strategy. The plan should include entry and exit points, risk management strategies, and the types of trades to focus on, such as day trading or swing trading. Sticking to a plan helps traders avoid emotional decisions, which can lead to losses in real-life trading. Consistency is crucial, as it will help beginners evaluate whether their strategies are effective over time.

Track and Analyze Your Trades

One of the most important steps in paper trading is keeping track of your trades. Beginners should maintain a detailed journal or log of all the trades they make, including the reasoning behind each trade, the outcome, and what they could have done better. This process allows traders to review their performance and learn from their mistakes. Regularly analyzing past trades helps identify patterns, improve decision-making, and fine-tune strategies. The more data traders collect, the more insight they will gain into their trading behavior and potential areas for improvement.

Be Patient and Stay Committed to Learning

Paper trading can be exciting but also a long-term learning process. Beginners should be patient and take the time to learn from their mistakes. It’s important to remember that becoming successful in trading requires dedication and practice. Paper trading allows beginners to experience losses without the emotional and financial stress of losing real money, allowing them to adjust their approach before entering the live market. Staying committed to continuous learning and improvement will help beginners build the skills to succeed in real trading.

If you’re new to paper trading, it’s important to consult advice and strategy from experts and professionals with experience in this type of simulation.

SoFi says, “Paper trading can be a way to learn about investing. By keeping track of all trades, and the losses or gains they generate, it creates a low-stress practice for examining why certain stocks, and certain trades, perform the way they do. That can be invaluable later, when there’s real money on the line.”.

For beginners looking to learn the ins and outs of trading, paper trading offers a safe and effective way to practice without risking actual money. By starting small, sticking to a consistent plan, tracking trades, and staying patient, novice traders can develop the skills and confidence needed for live trading. Whether focusing on one market or testing out various strategies, paper trading is an invaluable tool for learning and growth in finance.