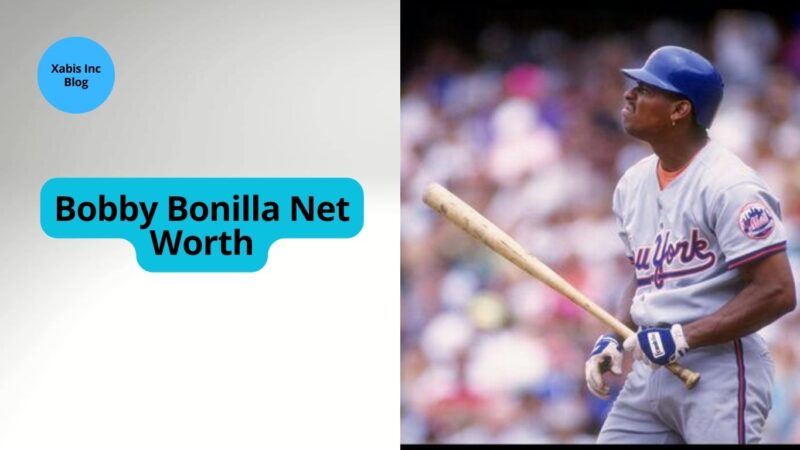

Bobby Bonilla, a former Major League Baseball (MLB) player, has been in the spotlight for receiving annual payments from the New York Mets long after his retirement. As of 2024, Bobby Bonilla’s net worth is estimated to be around $20 million, a testament to the financial acumen demonstrated through his unique deferred payment agreement. At the age of 61, Bonilla continues to benefit from this arrangement, which has intrigued fans and financial analysts alike.

What is Bobby Bonilla’s Deferred Payment Agreement?

In 2000, Bobby Bonilla and the New York Mets reached a deferred contract buyout agreement. Instead of paying the remaining $5.9 million of Bonilla’s contract upfront, the Mets agreed to make annual payments of approximately $1.2 million to Bonilla for 25 years. These payments started on July 1, 2011, and will continue until July 1, 2035. The deal includes an 8% interest rate, which has significantly increased the total amount Bonilla will receive.

How Have Deferred Payments Impacted Bonilla’s Net Worth?

The deferred payment structure has had a profound impact on Bonilla’s net worth. Despite being retired for over two decades, Bonilla’s yearly payment of $1.2 million surpasses the earnings of several current MLB superstars. This consistent income has provided Bonilla with financial stability and security, ensuring he maintains a comfortable lifestyle long after his playing days ended.

How Does Bonilla’s Earnings Compare to Current MLB Players?

According to Spotrac, several MLB players earn less than Bonilla in 2023. For instance, many players have salaries ranging from $733,900 to $1 million. This comparison highlights the substantial nature of Bonilla’s annual payment, which is a result of the strategic deferred payment agreement. The guaranteed annual income has allowed Bonilla to out-earn many active players, despite not stepping on a baseball field for years.

What is the Financial Impact of the Deferred Agreement?

The financial impact of the deferred agreement on Bonilla’s situation is substantial. The 8% interest rate applied to the annual payments has significantly increased the total amount Bonilla will receive by the end of the agreement. This foresighted financial planning has provided Bonilla with a steady income stream, ensuring financial security and allowing him to live comfortably during his retirement years.

How Has Bonilla Capitalized on His Unique Financial Situation?

In recent years, Bonilla has found innovative ways to capitalize on his unique financial situation. Along with his former agents, Bonilla has commemorated his annual payday with a package of original NFTs. This venture into the digital space not only celebrates his financial acumen but also showcases the creative ways retired athletes can leverage their legacy and unique circumstances for continued financial gain.

What Insights Have Bonilla’s Former Agents Provided?

Dennis Gilbert, one of Bonilla’s former agents, has emphasized the importance of securing financial stability for retired players. He highlights the strategic thinking behind Bonilla’s deferred payment deal, noting that it was designed to provide long-term financial security. Gilbert’s insights shed light on the meticulous planning and foresight that went into structuring Bonilla’s agreement, ensuring he would benefit financially for many years after his retirement.

How Does Bonilla’s Deal Compare to Other Lopsided Sports Deals?

While Bonilla’s deal is one of the most famous in sports history, it is not the only lopsided deal. Comparing his agreement with other notable sports contracts provides a broader perspective on the financial strategies used by athletes and teams. These deals often involve deferred payments and other financial instruments designed to provide long-term security for athletes while managing the team’s financial commitments.

Conclusion

Bobby Bonilla’s net worth in 2024 is a subject of great interest due to the unprecedented deferred payment agreement he made with the New York Mets. This arrangement has not only provided Bonilla with a consistent income stream but also sparked discussions about the financial security of retired athletes. The analysis and insights into Bonilla’s financial situation and the innovative ways he has capitalized on his unique deal highlight the importance of strategic financial planning for athletes. Bonilla’s story serves as a valuable case study for both current and future athletes looking to secure their financial futures long after their playing days are over.